Include VAT in Recipient

Depending on how you work, you'll want to set up your Agency's Strategy including VAT, excluding it, or maybe leaving it out.

Should I include VAT in the Recipient's Strategy for my services' Invoices?

If you need to invoice with VAT, you have two ways to do this, either create your Strategies including the VAT, or excluding the VAT. Now, depending on how you've set up your strategies, you'll have to add it when generating the invoice or not.

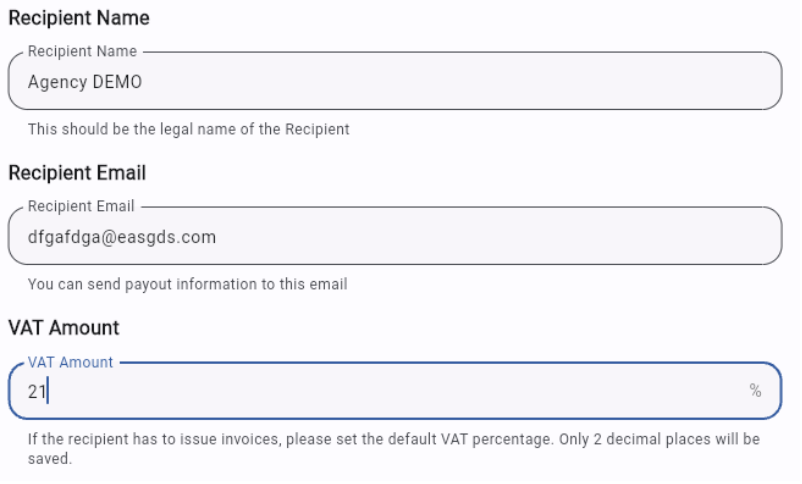

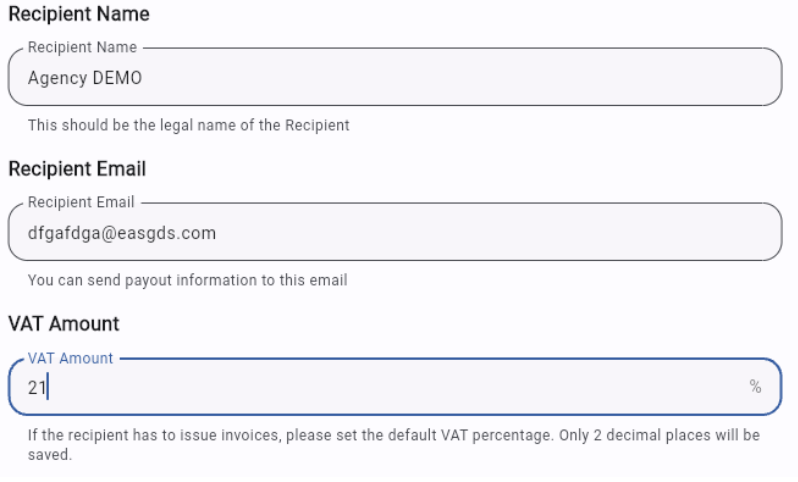

The section dedicated to the VAT in the Recipients' Strategy setup page is mainly dedicated so you can determine the default VAT that needs to be added to the Invoices generated for that recipient -when your strategies do not include the VAT.

1. VAT EXCLUDED FROM STRATEGY:

Indicate the VAT amount in the details of your Recipients

When setting up the Recipients' Strategies, do not consider the VAT amount. For example: if you charge 20% Commission + VAT, your Strategy will be just 20%.

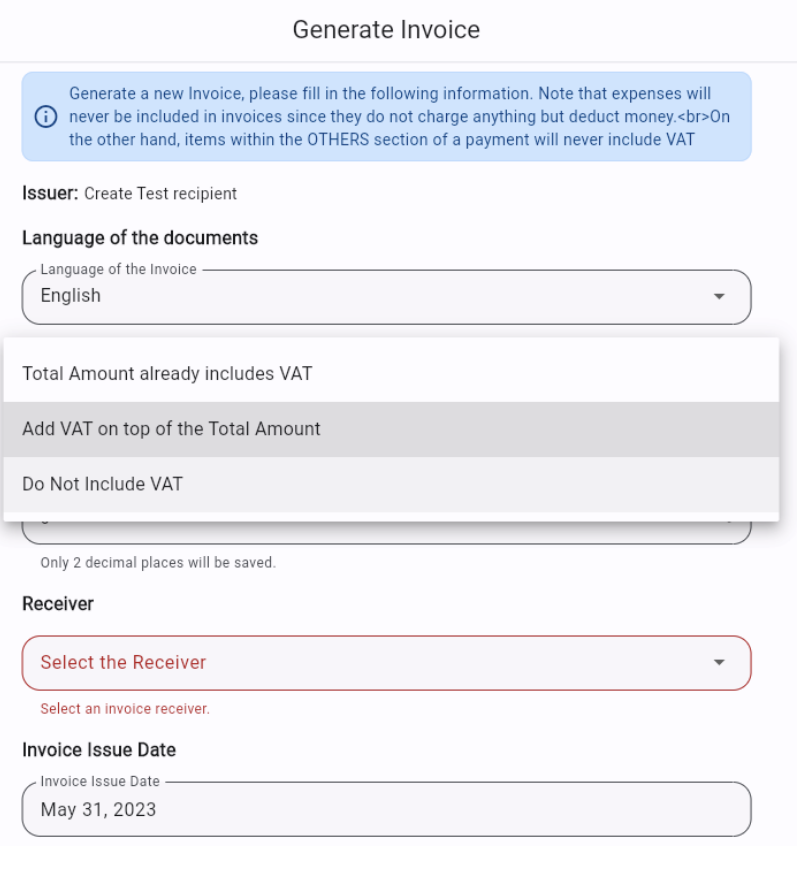

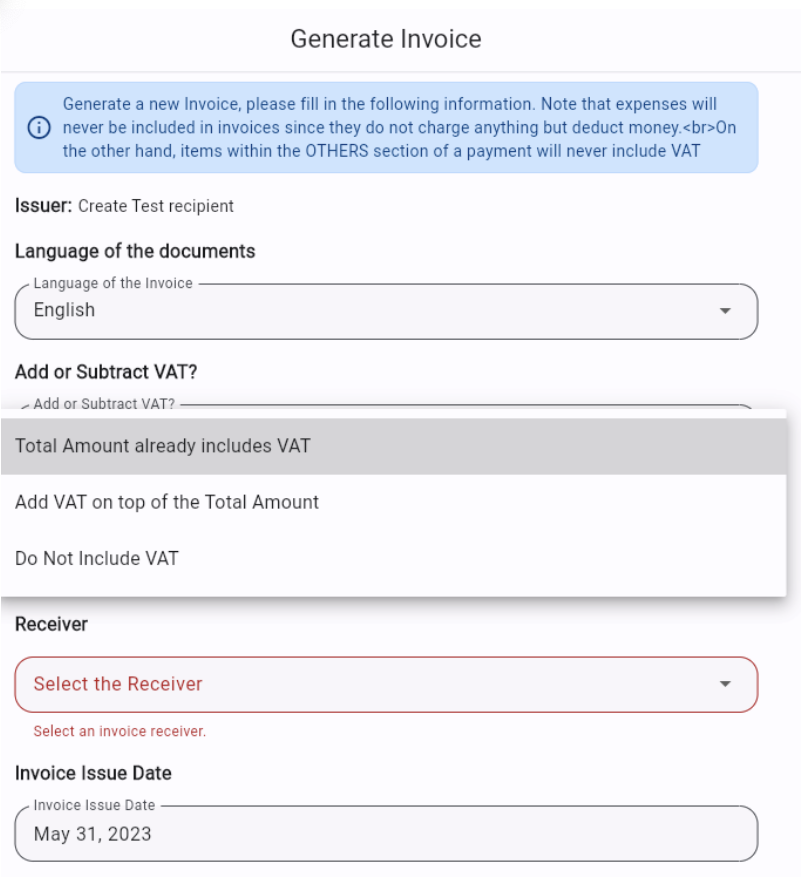

When you're going to generate the Invoices, you'll indicate "VAT not included" OR "Add VAT on top of the Total Amount"

Please note that when you choose to "add the VAT on top of the Total Amount", the amount indicated in the Payment will differ to the final amount on the Invoice, because in the Invoice the VAT is added on top of the total amount of the Payment.

2. VAT INCLUDED IN STRATEGY:

Indicate the VAT amount in the details of your Recipients

If you wish your Invoices to include the VAT AND have the amount of the Payment match the Invoice amount, we suggest that you add the amount of the corresponding VAT in the Strategy directly.

As an example, if I charge a 20% commission from the Rental Price, and the VAT that applies is the 21% on that 20%, the percentage that I'll indicated in my strategy for the Rental Price will be 24'2% (=20%*1,21) ![]() 3. When you're going to generate the Invoices, you'll indicate "VAT already included".

3. When you're going to generate the Invoices, you'll indicate "VAT already included".

When opting for this option, the amount indicated in the Payment will be equal to the Invoice.