How can I calculate my Commission over the Gross Income of the Booking?

The Strategies apply on Booking income - channel commissions. What to do if I charge my commission on Booking income incl. channel com.?

In the Accounting Module, *the Recipient's Strategies are applied on the Booking Incomes - the Channel Commissions,*this means that the agency's Commission is always applied on the NET income of the Bookings.

However, what should you do IF you need to calculate the agency's commission of the GROSS income (total Booking income INCLUDING Channel commissions)?

To do this, we recommend the following:

Apply the usual agency's commission in the Strategies of the Recipients.

Create the Statement and related Payments for all Recipients.

Calculate the agency's commission over the total amount of Channel commissions with the use of the Statement.

Manually add the result of point 3 to the agency's payment.

Manually detract the result of point 3 of the Rental Owner's payment.

Let us explain it with the use of an example

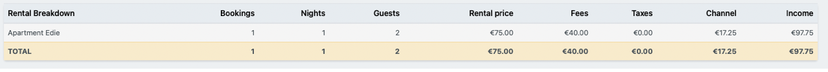

A Booking was made by a Guest through external Booking Channel.

The total Rental Price = 115€.

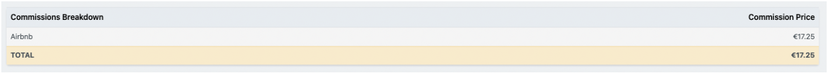

Channel commission = 17,25€ (=15%)

Net Rental Price= 97,75€ (115-17,25)

Agency commission charged to Rental Owner: 20%

The agency charges his commission over the GROSS income of the Booking, thus 20% of 115€ = 23€

Desired outcome: The Rental Owner should earn: 115€ - 23€ (agency commission) - 17,25€ (Channel commision) = 74,75€

How to do my accounting?

1.Initial setup - Recipients' Strategies:

Agency: Should earn money from Rental Price, 20%

Rental Owner: Should earn money from Rental Price, 80% (only for the Rental Owner's properties)

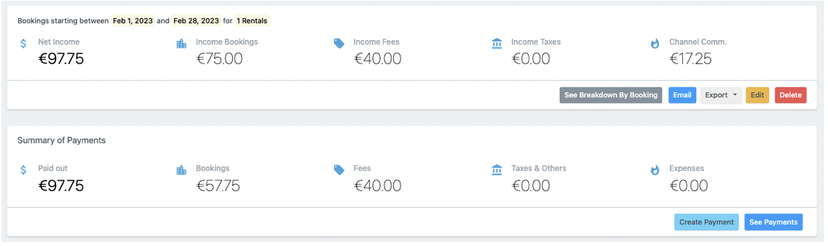

2. Create your Statements and related Payment (this can be automated through the Scheduled Statementsfunctionality)

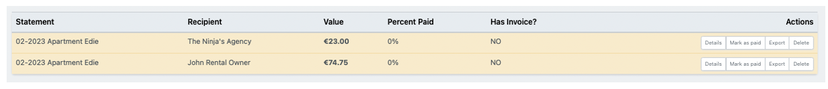

The outcome of the Payments will be:

Agency: 20% of NET Rental Price (97,75) = 19,55€

Rental Owner: 80% of NET Rental Price (97,75) = 78,20€

Check the Channel commission amount in your Statement and Calculate the agency's commission from the total amount of Channel commissions:

In this case: 20% of agency commission from 17,25€ of Channel commission: 0,2 * 17,25: 3,45€

Add the result of point 3 to your Payments. Agency's Payment: Add item, Fee, +3,45€

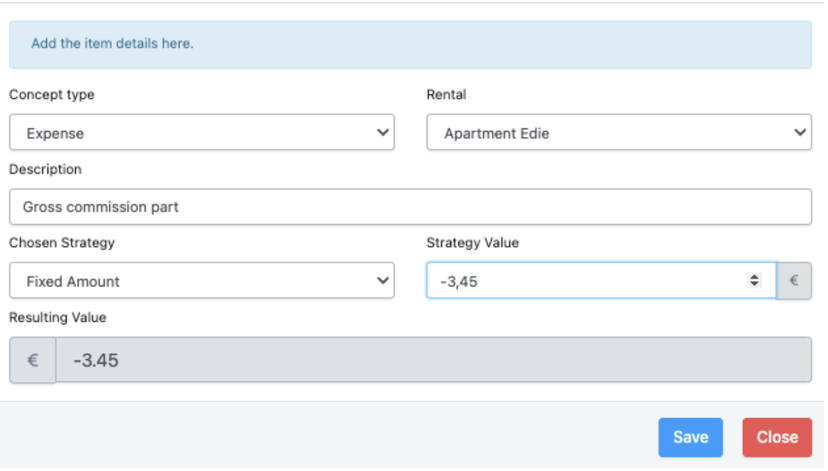

![]() Rental Owner's Payment: Add item, Expense, -3,45€

Rental Owner's Payment: Add item, Expense, -3,45€

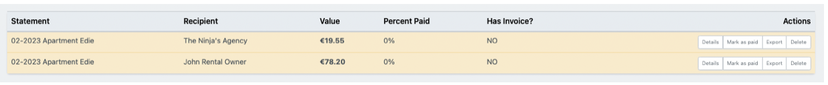

Doing so, the result of the Payments will be:

Agency: 19,55+3,45€ = 23€

Rental Owner: 78,20-3,45€ = 74,75€

(Same numbers as shown in the beginning of this example)