Gaining income on Cleaning Fee

Uncover the disparity between the cleaning fee charged to guests and the actual payment to the cleaning service to maintain transparency

How to do your Accounting when the Guest pays a higher amount for the Cleaning Fee than the amount charged by the Cleaning company/agent to you?

In case of a Cleaning Amount to pay Per BOOKING

In the Strategy of the Rental Agency

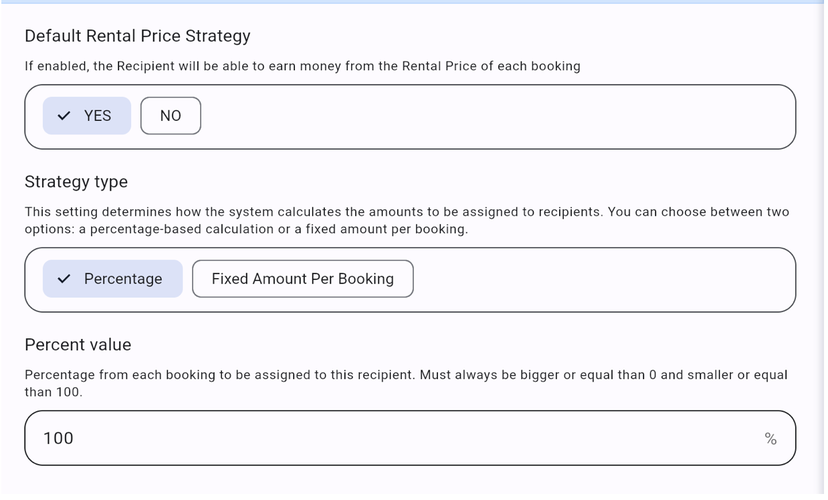

1. In the section of the Rental Price Strategy:

Select CAN EARN Money From Bookings (Rental Price) - Percentage - 100%

2. Recurring Expense:

NAME of choice - Fixed Per Booking - XX (cleaning fee amount to be paid per cleaning/booking)

THIS NUMBER HAS TO BE IN NEGATIVE as it is a COST for the Agency, otherwise it won't allow you to save it.

![]() Side note: after saving the Recurring Expense, you can Edit it and choose to only apply it to a few Rentals if this is needed.

Side note: after saving the Recurring Expense, you can Edit it and choose to only apply it to a few Rentals if this is needed.

In the Strategy of the Cleaning Service/Staff/Agent

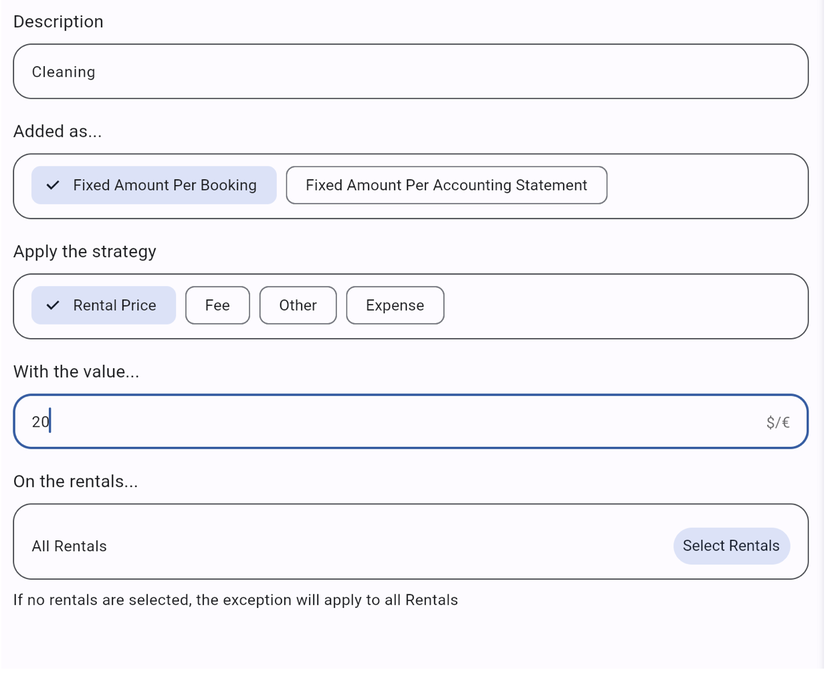

*1. In the section of the Rental Price Strategy *

Select CAN EARN Money From Bookings (Rental Price) - Fixed Amount per Booking - XX (this has to be the amount earned per cleaning/booking by the cleaning service, for example 20€).

This amount has to be equal to the Recurring Expense put in the Rental Agency's Strategy.

![]() OR You can set it up in the Recurring Items section of the Recipient.

OR You can set it up in the Recurring Items section of the Recipient.

If you do so, make sure to choose the Rentals to which the Recurring Items should apply.

In case of a Cleaning Amount to pay per Accounting Statement

This can be per month, per week etc, depending on how often you create your Statements. By most users this is done Monthly.

A. In the Strategy of the Rental Agency

1. In the section of the Rental Price AND Fee Strategy:

Rental Price: Select CAN EARN Money From Bookings (Rental Price) - Percentage - 100%

Fee: Select CAN EARN Money From Fee - Percentage - 100% (if you have multiple Fees, use the Exceptions and create different Strategies for all Fees by using keywords )

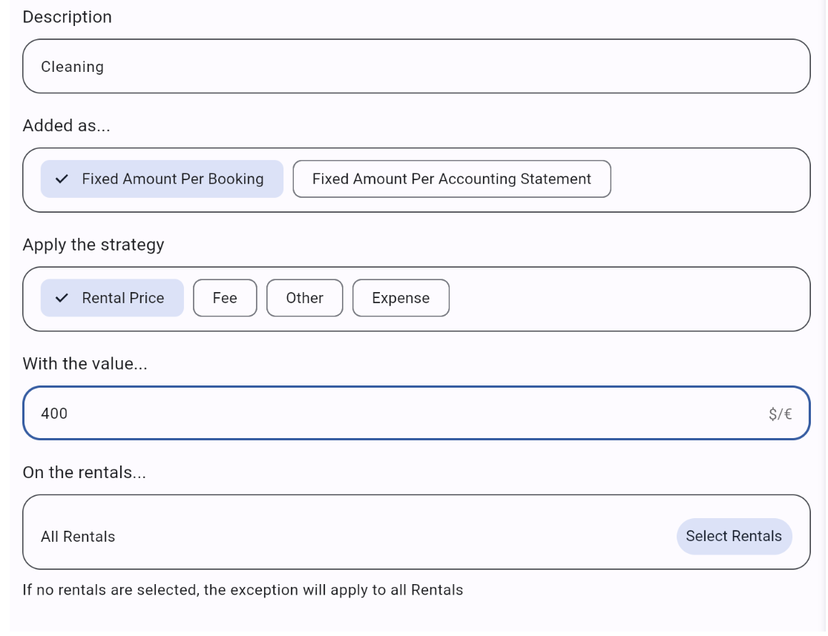

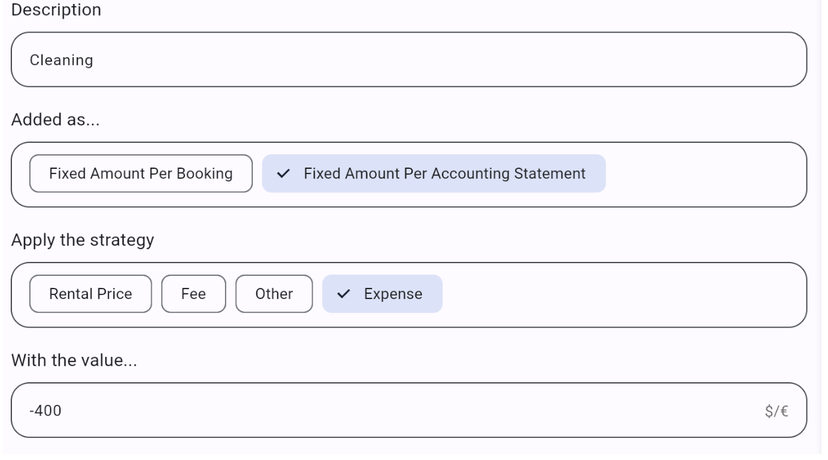

2. Recurring Item:

NAME of choice - Fixed Per Accounting Statement - XX (cleaning fee amount to be paid per cleaning/booking)

THIS NUMBER HAS TO BE IN NEGATIVE as it is a COST for the Rental Agency.

For example: 400€. This should be the exact amount charged to the Agency by the Cleaning Service.

B. In the Strategy of the Cleaning Service/Staff/Agent

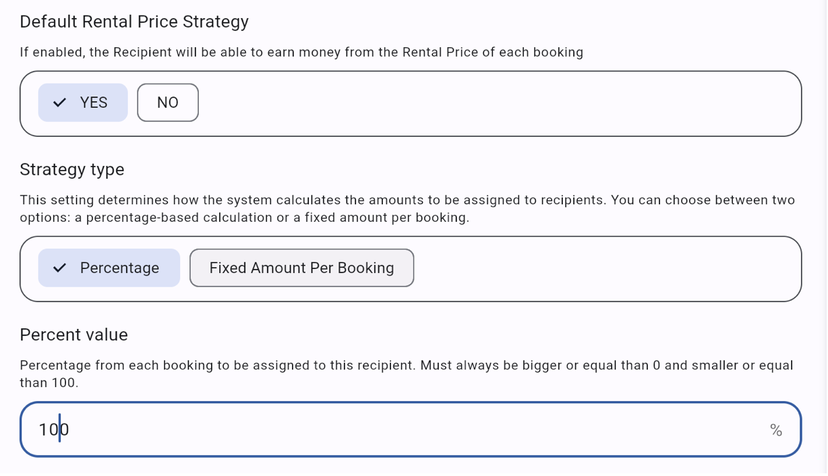

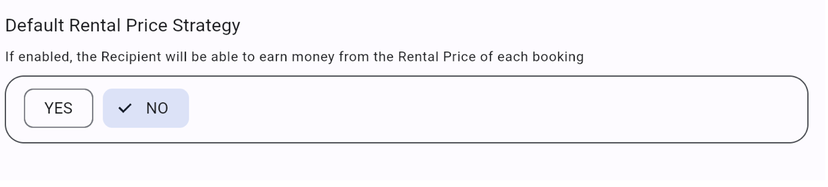

1. In the section of the Rental Price Strategy

Select CANNOT EARN Money From Bookings (Rental Price)

2. In the section of Recurring Items

NAME of choice - Rental Price (or Fee) - Fixed Per Accounting Statement - XX (cleaning fee amount to be paid per period)

THIS NUMBER HAS TO BE POSITIVE as it is an INCOME for the Cleaning Agency.

For example: 400€. This should be the exact amount charged to the Agency by the Cleaning Service & Should be equal to the amount added as a Recurring Expense per Accounting Statement in the Rental Agencies Strategy.

It is very important you select BOOKING or FEE (or tax) in Concept Type. (If you select Expense or Other, this will not be included in the Invoice, if you create one).