CONSEILS POUR LE PUBLIC FRANÇAIS: Taxe Touristique/Taxe de Séjour

Comment séparer la Taxe de Séjour des autres frais

En France la Taxe de Séjour est normalement gérée et payée directement par les Canaux de Réservation (comme par exemple Airbnb) et non par l'Agence de Location.

Toutefois, la Taxe de Séjour sera TOUJOURS reflétée dans le Relevé Comptable et dans la Répartition des Réservations. Cette information ne peut pas être supprimée car elle contient le prix payé par le client et qui est envoyé à Rental Ninja par le Canal de Réservation à travers votre Channel Manager. Cependant, vous pouvez voir les détails de ces "Frais" toujours séparés dans l'onglet Frais de votre section "Relevés".

La Taxe de Séjour est considérée comme un frais par les Canaux de Réservation!

Afin de séparer la Taxe de Séjour dans la Comptabilité, parce que il ne sera pas payé par l'Agence ni pas par le Propriétaire Locatif, on vous propose de séparer ce Frais dans les Stratégies du Bénéficiaire.

Ci-dessous, nous allons vous montrer comment configurer cela, étape par étape:

Il est important que vous lisiez jusqu'à la fin de cet article pour être sûr que toutes les étapes seront complétées!

1. Assigner 0% de la Taxe de Séjour au Propriétaire Locatif + Agence Locatif + autre Bénéficiaire impliqué

Si vous NE voulez PAS que la Taxe de Séjour soit incluse dans aucun des paiements de vos Bénéficiaires, assurez-vous que vous ne leur avez pas assigné la Taxe de Séjour dans leurs Stratégies.

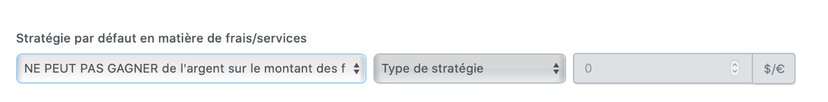

1a. Si vous avez seulement la Taxe de Séjour à titre de frais et vous n'avez pas d' autres Frais dans votre activité, les stratégies des Frais de vos Bénéficiaires susmentionnés ressembleront à cela:

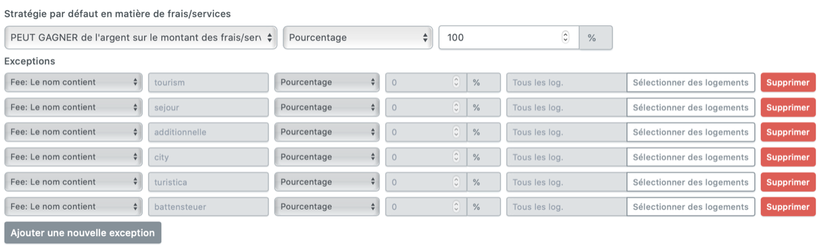

1b. Dans le cas où vous travaillez avec plusieurs Frais (par exemple Frais de Nettoyage, Frais de Linge, Frais pour un animal), tous ces Frais devront être assignées à un Bénéficiaire. Par conséquent, cela implique que les Stratégies de l'Agence Locative/ Propriétaire Locatif auront probablement des Exceptions dans leur Stratégie de Frais pour la Taxe de Séjour, indiquant qu'ils gagnent 0% de ces Frais. Voir ci-dessous:

(Si le Bénéficiaire gagne 0% de tous les Frais, en utilisant l'exemple du point 1a.)

NOTE: Rappelez- vous que vous devez créer une Exception pour chaque langue dans laquelle vous publiez la Taxe de Séjour sur chaque Plateforme de Réservation, quelques propositions/ exemple de nom à mettre dans les Exceptions sont: Séjour - Taxe - Additionnelle - Tourism - City.

*Peut être que votre Stratégie n'est pas comme la Stratégie de la capture d' écran. Cela dépend de plusieurs facteurs, comme le montant des Frais avec lequel vous travaillez - dans combien de Langues vous publiez vos Propriétés et qui gagne chaque Frais! *

2. Créer le Bénéficiaire "Taxe de Séjour"

Comme (selon la logique) vous devez assigner 100% des bénéfices entre vos Bénéficiaires, vous devrez créer un nouveau Bénéficiaire appelé "Taxe de Séjour" (ou tout autre nom que vous voulez lui donner).

Puis, comme conséquence de l'étape 1, vous devrez assigner toutes les Taxes de Séjour à ce Bénéficiaire, en indiquant qu'il gagne 100% de tous les Frais qui contiennent le mot "Tourism", "Séjour", "City", etc.

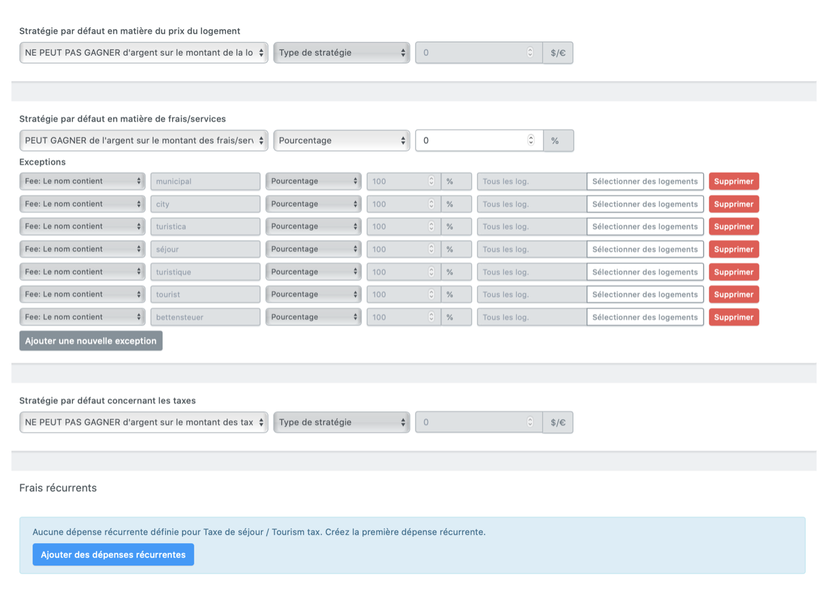

Laissez la Stratégie en blanc et assignez SEULEMENT la Taxe de Séjour à ce Bénéficiaire - assignez 100% de la Taxe de Séjour à ce Bénéficiaire.

C'est à dire que dans la Stratégie du Prix de Logement, des Taxes et des Dépenses Récurrentes, vous ne mettrez rien et vous le laisserez comme: NE PEUT PAS GAGNER.

Cela ressemblera à ce qui est montré ci-dessous:

Les Stratégies ont maintenant été configurées!

3. À la fin de la Période Comptable, lorsque vous créerez vos Relevés et les Paiements correspondant, vous devrez créer un "Paiement" supplémentaire pour le Bénéficiaire de la Taxe de Séjour.

En créant ce Paiement vous vous assurerez que tous les montants sont corrects, ce qui signifie que tout l'argent qui entre, est payé à quelqu'un.

Vous ne vous rappelez plus comment créer un Paiement? Cliquez ici.

EXEMPLE

Pour vous donner une image plus précise, supposons que vous avez plusieurs FRAIS, comme un Frais de Nettoyage, des Frais de Laverie et une Taxe de Séjour.

Supposons que les Frais de Nettoyage soient payés entièrement au Propriétaire du Logement, les Frais de Laverie à l'Agence Locative et la Taxe de Séjour est détachée au Bénéficiaire Taxe de Séjour. Dans ce cas, la partie "Frais" de la Stratégie des Bénéficiaires sera ainsi:

Agence Locative: ![]()

Taxe de Séjour: ![]()

Propriétaire du Logement: ![]()

Il est très important d'écrire correctement les mots des Exceptions.

Rental Ninja captera seulement les Frais dans les Exceptions qui incluent ce mot précis!