Add One Time Costs

Learn how to effectively incorporate one-time costs into your financial records with these essential tips on the platform Software.

How do I account for the following costs?

Electricity Bills that have a different amount every month

One Time Maintenance Costs

These costs cannot be predicted nor programmed, as they are not recurring costs or do not have a standard / predictable amount. For this reason, you will need to create them manually in your Payments - after the Statement has been created.

Step-by-Step Guide to Incorporating One-Time Costs in Your Accounting

Create your Payment as usual. If not done yet, click hereto learn how to do this.

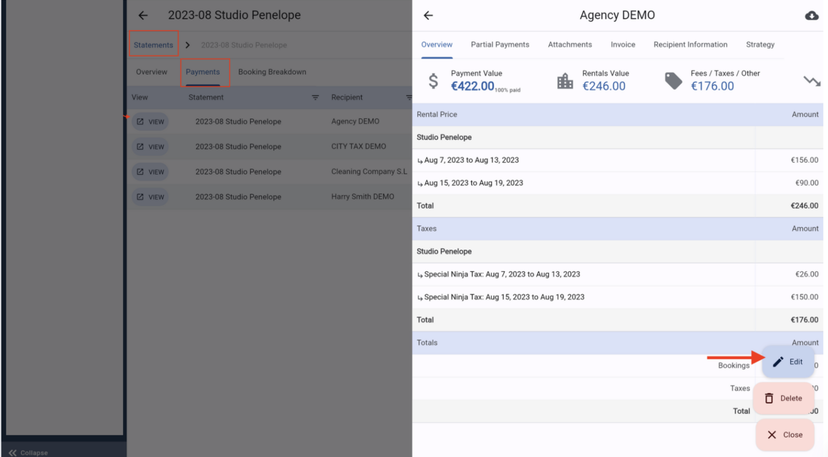

Go to Edit. Skip this step if you have just started creating the Payment and not yet saved it.

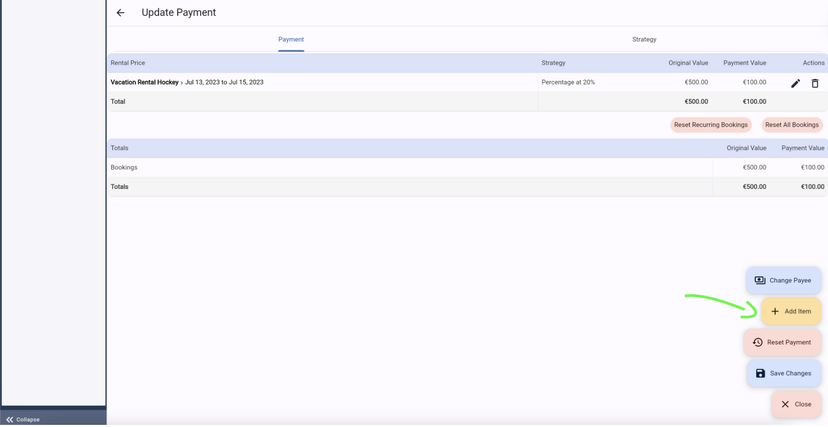

3. On the bottom of the page, you will see the Add Item button. It is inside the Show Actions button

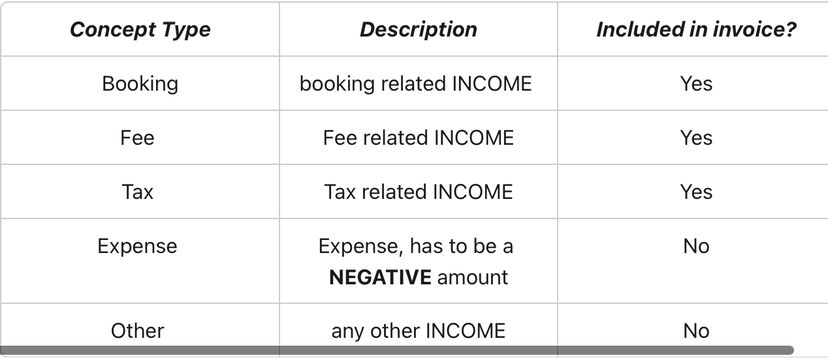

Choose the Concept type

If you are looking to include the Item in the Invoice that you will create for this Payment, make sure to choose Booking, Fee or Tax.

An Expense or Other item will Not be included in the invoice.

Fill in all the required remaining information

Click on Save

After saving the Item, make sure to Save the entire Payment by clicking on Save Changes on the bottom right side of your screen

Very important!

If you add an Item to a Payment, this reflects an Income that is not Directly paid by the Guest, such as utility fees for example.

This means that if you add an Income to 1 Recipient, you will need to add this (the same exact amount) as an Expense to another Recipient. The system acts like a balance *. *

If you do not balance it out, it will mean that the total amount of your Payments will not be the same as your Total Net Revenue in this Statement.

Let's see it with an Example

If you are using the "Add Item" function to add the Utility Fees to your Accounting,* we recommend you to create a separate Recipient for the Utility Fees.*

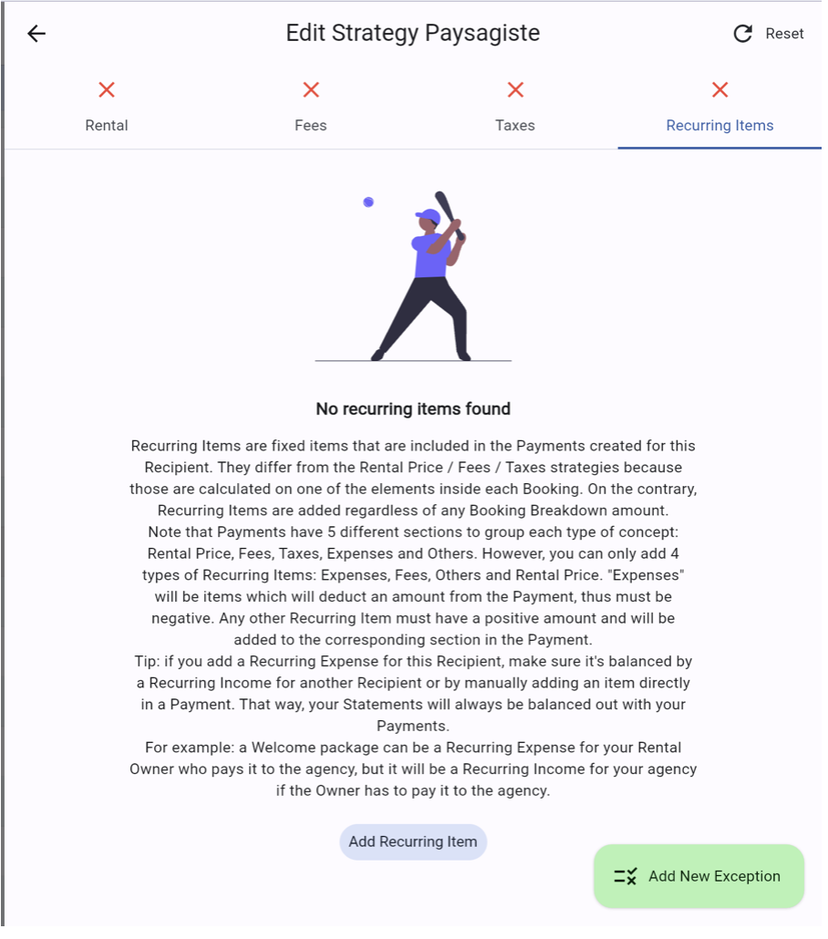

For this Recipient, you will give him a Blank Strategy, saying it CANNOT EARN money from anything:

When you start creating the Payments within your Statement, you will Also create a Payment for the Utility Fees Recipient. Go to "Add Item" and add the utility fees as a Fee (income) and save it. (see the Step by Step explanation above)

Remember to go to the Recipient, who is paying for these costs, and Add the Utility Fees as an EXPENSE to them.

Last notes:

You can Add Items before clicking on the "Looks Good, Create Payment" button, but also after saving it, meaning that you can edit the payment and the extra items at any time needed.

MAKE SURE TO NOT GENERATE ANY INVOICE UNTIL YOU'RE FULLY SURE THINGS ARE ACCOUNTED CORRECTLY IN EVERY PAYMENT!